12.07.2022

Proxima Research International provides the most current data on the development of the pharmaceutical market not only in Ukraine (the daily dynamics of the volume of pharmacy sales of drugs in Ukraine can be found here), but also in other countries. In particular, in Kazakhstan there are services available for monitoring retail and hospital consumption in monetary and unit terms, in USD and EUR equivalent of various categories of the “pharmacy market basket”*; data on the promotional activity of pharmaceutical companies and the doctors’ prescriptions.

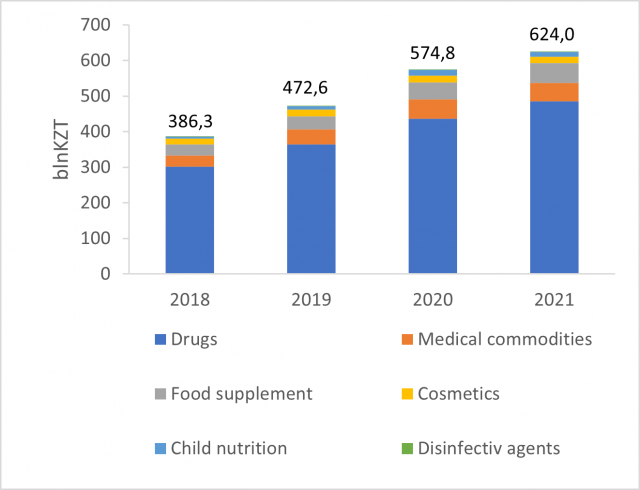

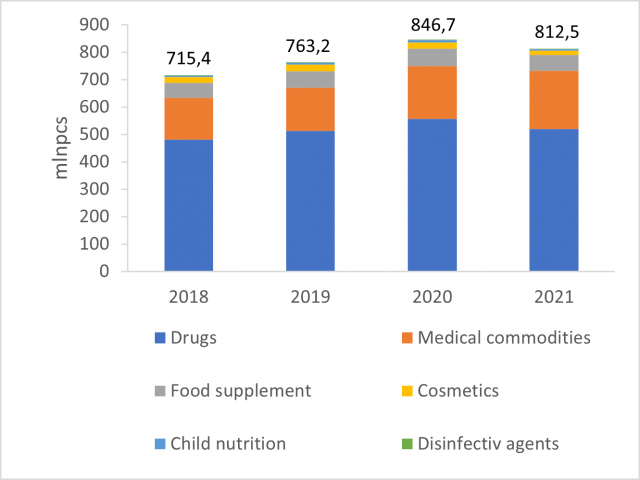

In 2021, the volume of retail consumption of goods from the “pharmacy basket” in Kazakhstan was 624 billion Kazakh tenge (Fig.1). Compared to the previous year, this indicator increased by 8.6%. In units, the volume of pharmacy sales was 812.5 million packages (Fig. 2).

Fig. 1 Retail sales of “pharmacy basket” goods in Kazakhstan between 2018 and 2021 in national currency

Fig. 2 Retail sales of “pharmacy basket” goods in Kazakhstan between 2018 and 2021 in units

Drugs form a significant part of pharmacy sales. In 2021, their specific weight in retail consumption in monetary terms was 77.7%. Medical products make up 8.4%, dietary supplements – 8.9%; the rest of the categories – 4.9%.

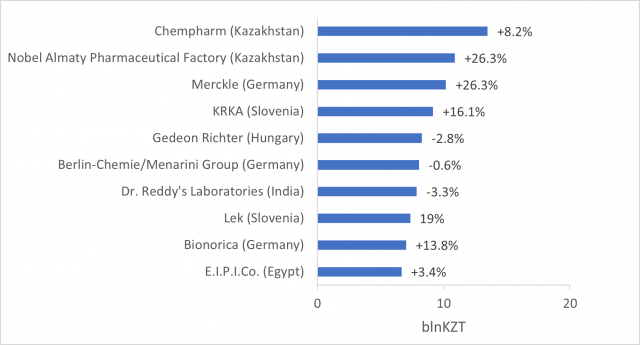

Among manufacturers, the leaders in terms of the volume of pharmacy sales of goods from the “pharmacy basket” are the companies Khimpharm, Nobel Almaty FF and Merckle (Fig.3).

Fig. 3 Top-10 manufacturers by the volume of pharmacy sales of “pharmacy basket” goods in monetary terms in Kazakhstan in 2021

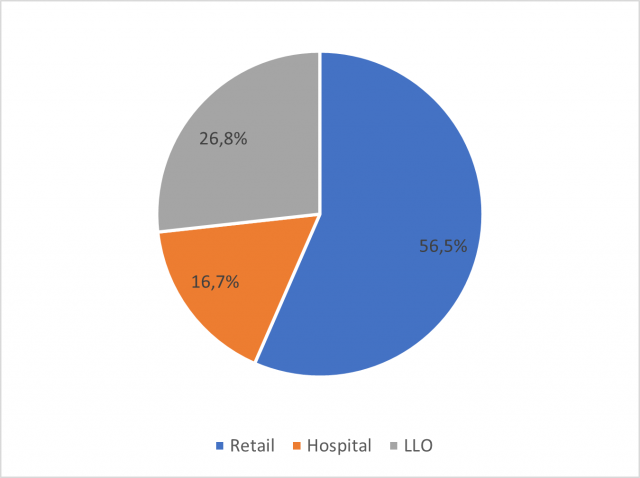

In 2021 in Kazakhstan, the volume of retail medications sales in monetary terms increased by 11.0% – to 485.1 billion Kazakh tenge – compared to the previous year. In total medication expenditures (including both government and out-of-pocket costs for consumers), retail accounts for 56.5%. (Fig.4). 16.7% form hospital consumption; 26.8% – Supplementary Medicines Program (SMP).

Fig. 4 Medications expenditures structure in Kazakhstan in monetary terms by sources of funding in 2021

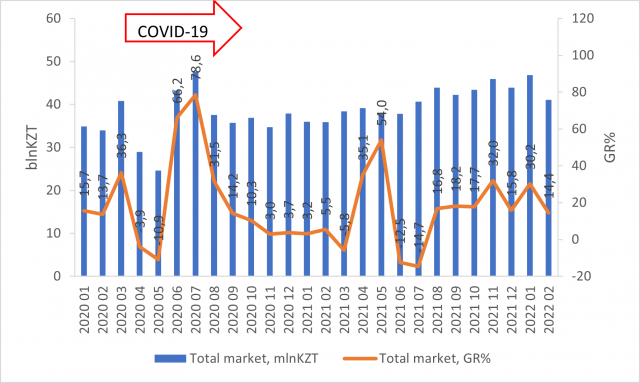

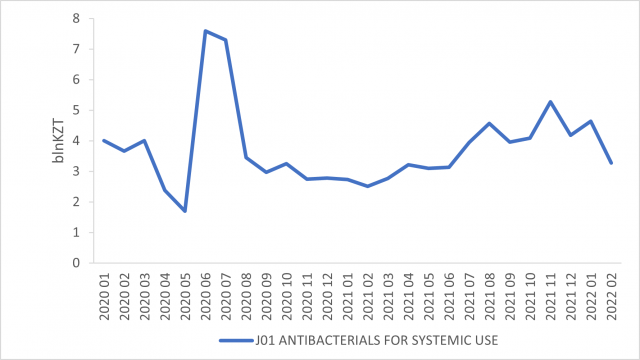

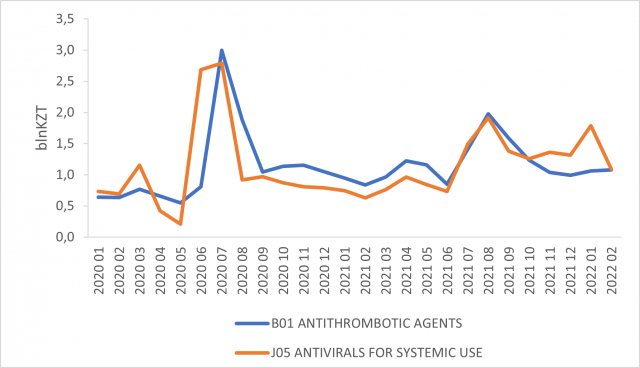

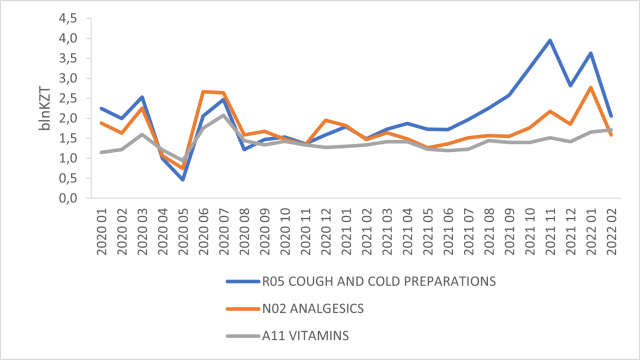

The monthly dynamics of pharmacy sales demonstrates the impact of the COVID-19 pandemic on the medications market (Fig. 5). Panic demand and increased need for certain groups of drugs have led to a rapid growth of certain categories of goods. Sales of antibacterial agents for systemic use (Fig. 6), antithrombotic and antiviral agents (Fig. 7) skyrocketed. The pandemic has also affected the cough and cold medicines, analgesics and vitamins (Fig. 8).

Fig. 5 The monthly dynamics of pharmacy sales of medications in Kazakhstan in monetary terms from January 2020 to February 2022, indicating the growth/decline rate compared to the same period of the previous year

Fig. 6 The monthly dynamics of sales of ATC group J01 “Antibacterials for systemic use” in monetary terms for the period from January 2020 to February 2022

Fig. 7 The monthly dynamics of sales of ATC groups B01 “Antithrombotic agents” and J05 “Antivirals for systemic use” in monetary terms for the period from January 2020 to February 2022

Fig. 8 The monthly dynamics of sales of R05-medications “Cough and cold preparations”, N02 “Analgesics” and A11 “Vitamins” in monetary terms for the period from January 2020 to February 2022

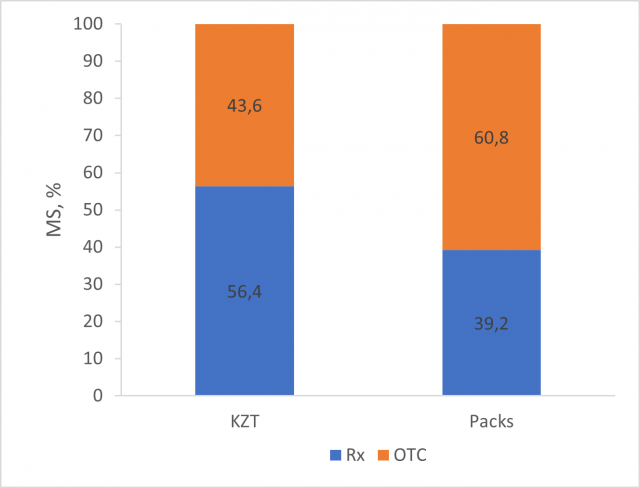

In terms of prescription status, over-the-counter drugs account for the major part of the structure of pharmacy sales in units. In monetary terms, the ratio is almost equal – 56.4:43.6 with a preference for prescription drugs.

Fig. 9 Structure of pharmacy sales of prescription and nonprescription drugs in Kazakhstan in monetary terms and units in 2021

The rating of medication brands in the prescription group is formed by Xarelto, Ursosan and Actovegin, in nonprescription group – Kreon, Canephron and Viferon (Table 1).

Table 1 Top-10 medications brands by volume of pharmacy sales in Kazakhstan in monetary terms in 2021

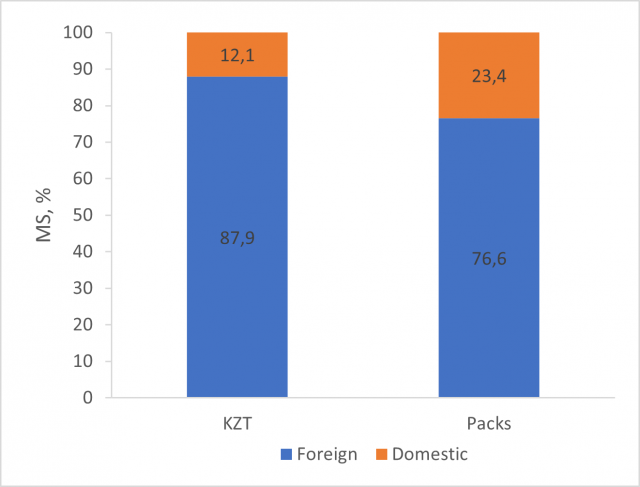

Fig. 10 Structure of pharmacy sales of domestic and foreign drugs (by production country) in Kazakhstan in monetary and unit terms in 2021

The share of medications of Ukrainian production in the structure of the retail market of medicines of Kazakhstan is 2.5% in monetary terms, and 3.9% in units. Among Ukrainian manufacturers, the leaders in sales volumes of drugs in Kazakhstan in monetary terms are Farmak, Halychpharm and Kyivmedpreparat.

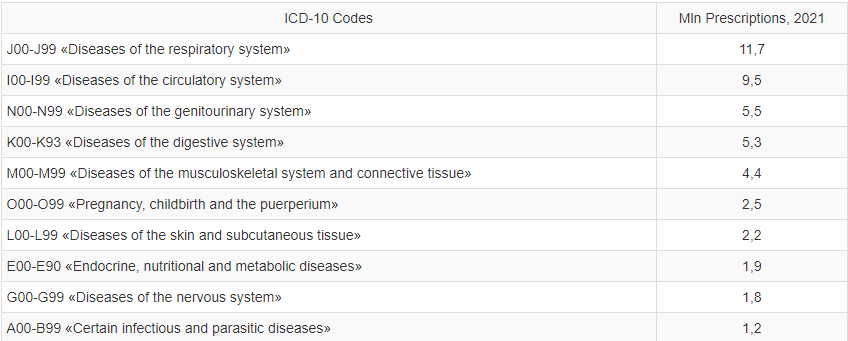

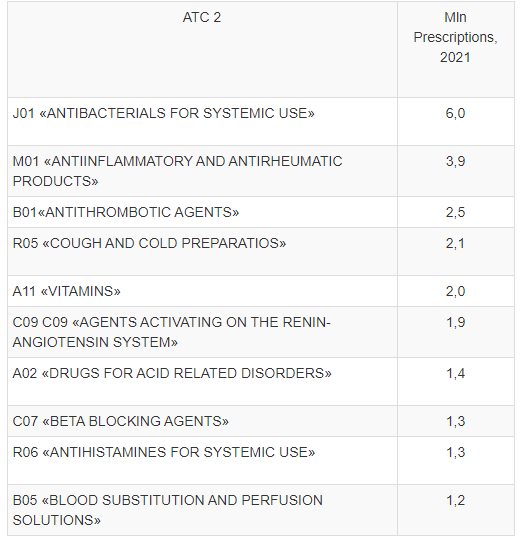

The major part of medicine prescriptions refers to respiratory diseases, as well as diseases of the circulatory system (ICD-10) (Table 2). In terms of the number of prescriptions by doctors, antibacterials for systemic use are at the top of the list (Table 3).

Table 2 Top-10 medical diagnoses according to ICD-10 by the number of prescriptions in 2021

Table 3 Top-10 2-tier groups of ATC by the number of doctors’ prescriptions in 2021 in Kazakhstan

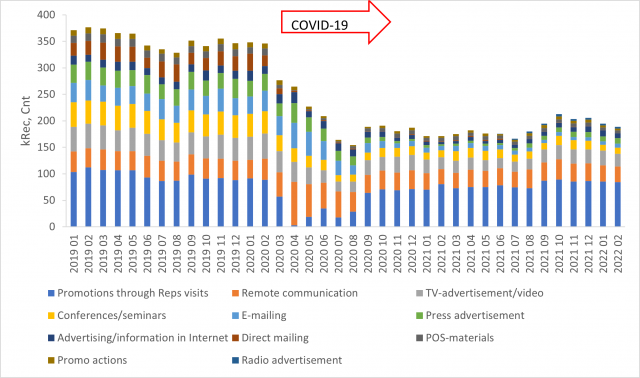

The overall level of promotional activity in Kazakhstan did not recover after the drop in 2020 against the background of the coronavirus pandemic (Fig. 11). In total in 2021, 2.2 million mentions of pharmacists and doctors about the promotion of medicines were recorded in Kazakhstan.

Fig. 11 The monthly dynamics of mentions of doctors and pharmacists in Kazakhstan about various types of promotion of medicines from January 2021 to February 2022

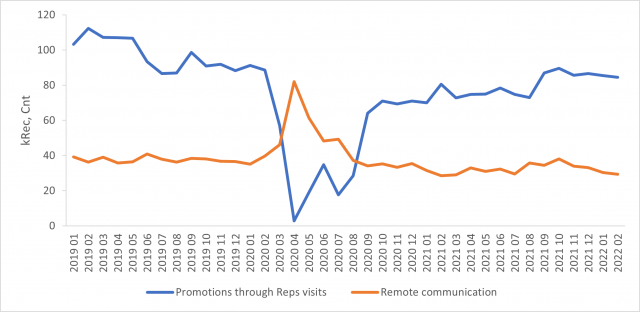

The main channel of promotion in the professional audience is visits of medical representatives. In 2021 and 2022, the level of business activity increases, but still remains lower compared to the pre-COVID period (Fig. 12). In April 2020, remote communication practically replaced the visits of medical representatives, but very quickly the number of mentions about this type of promotion returned to the pre-COVID level.

Fig. 12 The monthly dynamics of mentions of doctors and pharmacists in Kazakhstan about the promotion of medicines through visits of medical representatives and remote communication from January 2021 to February 2022

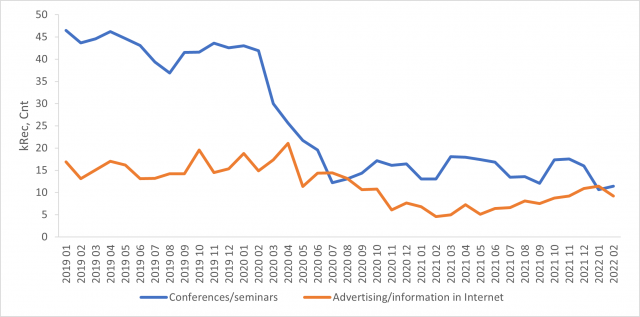

Since the beginning of the coronavirus pandemic, the number of mentions of conferences/seminars has significantly decreased (Fig. 13). The number of mentions of advertising/information on the Internet also decreased slightly, but at the end of 2021 – early 2022 a positive trend emerged.

Fig. 13 The monthly dynamics of mentions of doctors and pharmacists in Kazakhstan about the promotion of medicines through conferences/seminars and advertising/information on the Internet from January 2021 to February 2022

“PHARMACY Weekly” Press Office

*Medicines, cosmetics, medical products, baby food, disinfectants

** 15 specialties: therapists, gynecologists, pediatricians, cardiologists, neurologists, otolaryngologists, anesthesiologists, surgeons, dermatologists/venereologists, endocrinologists, orthopedists/traumatologists, urologists, allergists/pulmonologists, gastroenterologists, rheumatologists.

*** By the number of mentions of pharmacists and doctors of 15 specialties: allergists/pulmonologists, anesthesiologists, gastroenterologists, gynecologists, dermatologists/venereologists, cardiologists, neurologists, orthopedists/traumatologists, otolaryngologists, pediatricians, rheumatologists, therapists, urologists, surgeons, endocrinologists.